January is Teen Driving Awareness Month. Having had many teen drivers myself (my last currently with a driving permit in hand), I can't stress enough the importance of consistently having these conversations.

According to the National Highway Traffic Safety Administration (NHTSA) and the National Safety Council, when teens begin to drive, the sobering statistics start to pile up:

- Car crashes are the leading cause of death for U.S. teens ages 14 through 18.

- A teen’s crash risk is three times that of more experienced drivers.

- Being in a car with three or more teen passengers quadruples a teen driver’s crash risk.

- More than half of teens killed in crashes were not wearing a seat belt.

You can help your young driver make better decisions behind the wheel, however. Start by setting a good example yourself. And set time aside to have a serious discussion about the following issues, all of which have a large impact on the safety of teen drivers:

- Speed: According to the Governors Highway Safety Association, speeding continues to grow as a factor in fatal crashes involving teen drivers. While a lot of emphasis is rightfully placed on the risks of driving under the influence or while distracted, the danger of speeding is just as important.

- Alcohol: If drivers are under 21, driving with any amount of alcohol in their system is illegal. It’s as simple as that. And not only does the risk of a serious crash increase once alcohol is involved, jail time is a possibility as well.

- Seat belts: Teens don’t use their seat belts as frequently as adults, so it’s important to set a good example and always have yours on. Seat belts are the simplest way to protect themselves in a crash, so let teens know that buckling up is mandatory.

- Phones: You are 23 times more likely to crash while texting. STOP! Distracted driving is dangerous driving, especially for an inexperienced teen. That means no calls or texting when behind the wheel — no exceptions. Again, it pays to set a good example when you’re driving with your teen in the car.

- Passengers: The risk of a fatal crash goes up as the number of passengers in a teen driver’s car increases, according to the NHTSA. Depending on your state’s licensing laws for young drivers, limiting your teen to one passenger is a good guideline. (And some states don’t allow teens to have any passengers for a time.)

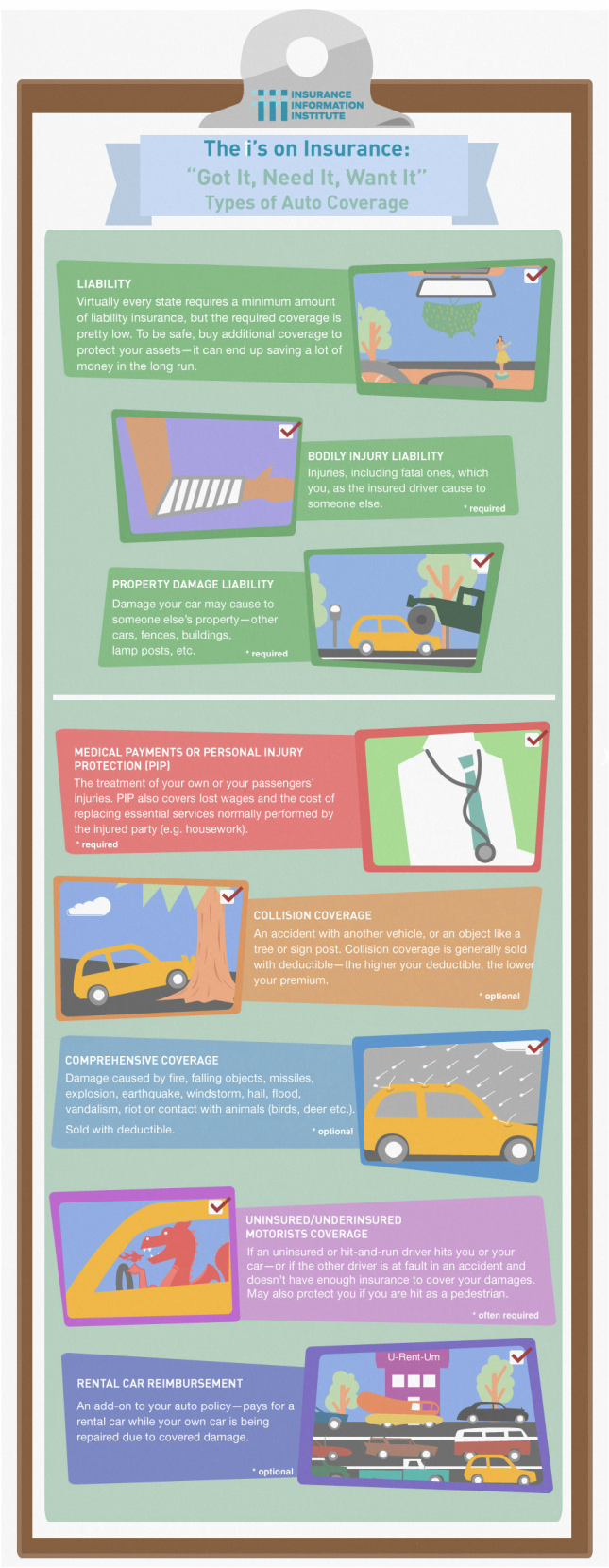

ALINK Insurance Services wants you and your teen(s) to stay safe on the roads! Give us a call today to discuss the effects of having a teen on your auto insurance and to make sure you have the coverage you need. We're your link to security!

Denver Metro/Parker: 303-752-6479

Colorado Springs: 719-473-6262

Greeley: 970-475-0900

Surrounding States: 877-643-6148

RSS Feed

RSS Feed